JEPI Quick Summary

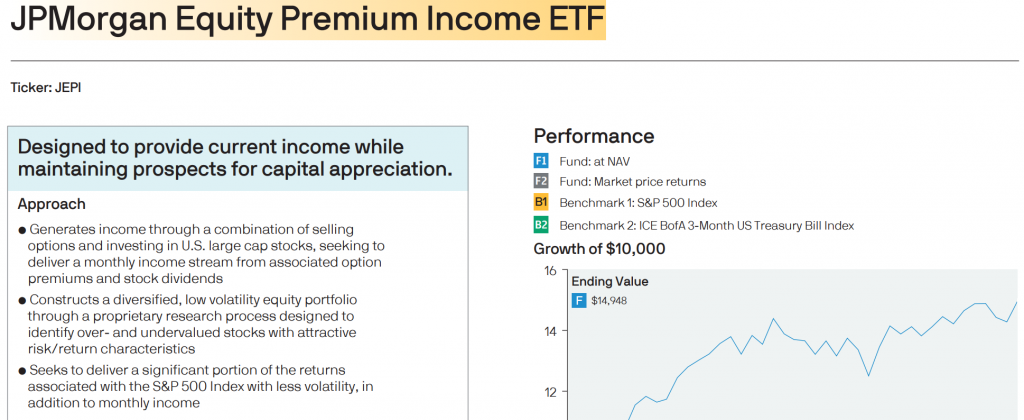

The JPMorgan Equity Premium Income ETF, stock ticker JEPI, is an Exchange Traded Fund by JP Morgan Chase with the primary aim to provide investors with a source of current income, alongside the possibility of capital appreciation. Its strategy involves a combination of option selling and investing in large-cap stocks within the U.S., which is engineered to produce a monthly income from the premiums of the options and the dividends from the stocks. This method strives to offer a share of the returns similar to those of the S&P 500 Index, but with reduced volatility, which may appeal to income-focused investors with a cautious stance towards market fluctuations.

Key Strategies:

- Large-cap U.S. equities: Over 80% of assets in value-oriented stocks with potential for high dividend yields.

- Equity-Linked Notes (ELNs): Up to 20% allocation, generating income through writing call options which caps potential upside in rising markets.

- Active portfolio management: Research-driven approach considering valuation metrics, company fundamentals, and potential catalysts.

Investment Goals:

- Generate consistent income via options premium.

- Maintain capital appreciation potential while reducing volatility compared to the S&P 500.

Volatility Management:

- Focus on value characteristics and lower beta stocks aims to reduce overall portfolio volatility.

- ELNs further limit potential downside by capping gains at the strike price.

Risks and Considerations:

- Capped upside: ELNs restrict gains in strong markets, missing out on full S&P 500 performance.

- Counterparty risk: Relies on ELN issuers fulfilling their obligations.

- Liquidity risk: ELNs may be less liquid than traditional securities.

- Tax implications: Consult a tax advisor to understand the impact of income distributions.

Launched on May 20, 2020, JEPI oversees a portfolio currently valued at approximately $30 billion, indicating a robust level of investor interest and confidence. The fund maintains a gross and net expense ratio of 0.35%, which places it within a competitive range for cost-conscious investors.

JEPI’s approach represents an avenue for investors seeking a blend of income and growth potential in their investment portfolios. Its dual strategy of capitalizing on both equity market gains and options-derived income aims to cater to those looking for monthly income while potentially dampening the impact of market volatility.

What is JEPI’s Investment Strategy?

JEPI employs a distinctive investment approach that hinges on a combination of selling options and selecting large-cap stocks from the U.S. market. This dual strategy is centered on generating income while also fostering an environment conducive to capital appreciation. The ETF’s methodology is not purely focused on immediate returns but is carefully calibrated to achieve a steady flow of income through the collection of option premiums and the dividends yielded by the stocks held in the portfolio.

The portfolio’s composition is the result of a rigorous proprietary research process aimed at identifying stocks that are either undervalued or overvalued, each evaluated for their risk and return profiles. The ultimate goal is to emulate a significant portion of the S&P 500 Index’s returns, while simultaneously reducing volatility. This could potentially make JEPI an appealing choice for investors who are income-focused yet remain cautious about the market’s ups and downs.

A deeper dive into JEPI’s holdings reveals a commitment to diversification, with a spread across various sectors. Among its top holdings as of the document’s publication are recognizable names such as Microsoft, Adobe, and Amazon, indicating a tilt towards companies with robust market presences. This diversification is a strategic move designed to mitigate risks associated with single-stock exposure and market fluctuations.

JEPI’s investment strategy, while aiming for income generation and capital appreciation, involves an inherent level of risk, as with any investment in the stock market. Potential investors should consider their own risk tolerance and investment goals when evaluating JEPI as a part of their portfolio.

How Does JEPI Work to Generate Income?

JEPI’s income generation strategy is a blend of selling options and investing in U.S. large-cap stocks. This combination is designed to provide a steady income stream while maintaining prospects for capital appreciation, making it a unique offering in the realm of income-generating investments.

The first component of JEPI’s income strategy involves investing in a diversified portfolio of large-cap U.S. stocks. These stocks are selected through a proprietary research process that aims to identify companies that are either undervalued or overvalued, based on their risk/return characteristics. The dividends received from these stocks contribute to the fund’s income.

The second, and perhaps more distinctive, aspect of JEPI’s income strategy is its use of an options selling strategy. This involves writing, or selling, options on the stocks in its portfolio. When an investor sells an option, they collect a premium from the buyer of the option. These premiums are a source of income for the fund and are distributed to investors in the form of dividends. The success of this strategy, however, hinges on the accurate assessment of market conditions and stock valuations.

Options selling can be a complex and risky endeavor, as it involves predicting market movements and requires active management. The fund’s managers use their expertise and experience to navigate this complexity and manage the risks associated with options trading. The performance of this strategy can be influenced by market volatility, with higher volatility leading to higher option premiums and vice versa.

JEPI’s approach to income generation through both dividends from its equity holdings and income from its options strategy offers a unique way for investors to gain exposure to the equity markets while receiving a regular income. This strategy, however, involves a higher level of complexity and risk compared to traditional dividend-paying stocks or funds, and it requires a thorough understanding of both the equity and options markets.

JEPI’s Historical Performance Compared to S&P 500 ETF

When examining JEPI’s historical performance:

- In 2023, JEPI showed a positive return of 9.81%.

- The year 2022 saw a decrease in JEPI’s performance with a -3.52% return.

- During 2021, the fund achieved a significant gain of 21.50%.

This performance data provides a perspective on how JEPI has managed to navigate different market conditions over the years.

Comparing JEPI to SPY

To put JEPI’s performance in context, it’s useful to compare it with SPDR S&P 500 ETF Trust (SPY), a fund that tracks the S&P 500 Index:

- SPY in 2023: Registered a strong gain with a 26.19% return.

- SPY in 2022: Experienced a notable downturn, recording a -18.17% return.

- SPY in 2021: Similarly to JEPI, SPY had a robust performance year, with a 28.75% return.

JEPI has shown a capacity to manage volatility, especially in down markets, as seen in 2022. Its strategy, involving a mix of dividend-paying stocks and an options strategy, seems to contribute to this resilience. However, in terms of growth, especially in a bullish market, JEPI may not fully match the returns of an ETF like SPY that closely tracks the broader market.

Why is JEPI Dividend So High?

JEPI’s approach to dividends is integral to its overall strategy, which is centered on providing investors with a regular income stream. Dividends are a portion of a company’s earnings distributed to shareholders, and for JEPI, these are a key component of the return to investors, alongside the income generated from selling options. JEPI’s intent is to distribute these dividends on a monthly basis, which can be particularly attractive to investors who desire frequent income payouts.

The fund’s ability to pay dividends stems from two main sources within its portfolio: the dividends received from the large-cap stocks it holds, and the option premiums collected from its options selling strategy. This combination allows JEPI to maintain a steady flow of income, which is then passed on to investors through its monthly dividend payments.

As of the latest available data, JEPI has demonstrated a robust yield profile. The 30-day SEC yield, an annualization of the fund’s dividend income over the past month, stood at 8.66% as of November 30, 2023. This figure aligns with the unsubsidized yield, which excludes any fee waivers or expense reimbursements, suggesting that the reported yield is a true reflection of the fund’s income-generating capability. Additionally, the 12-month rolling dividend yield, which provides a snapshot of the total dividends paid out over the past year relative to the fund’s price, was 9.14%. This rate can fluctuate, reflecting changes in dividend payments and fund price.

It’s important for investors to understand that while the yields are a significant indicator of a fund’s income-generating ability, they should also consider the sustainability of these yields, the underlying assets generating the income, and the overall performance of the fund. The yields can be influenced by a variety of factors including market conditions, the performance of the underlying stocks, and the success of the options strategy.

Investors should also be aware that dividend distributions are subject to taxes, and the tax treatment of these dividends can affect the net income they receive. JEPI’s dividends, as with those from other equity investments, may be classified as qualified or non-qualified for tax purposes, which has implications for the investor’s tax liability.

JEPI’s handling of dividends is a core aspect of its investment proposition, aiming to provide a consistent and potentially high monthly income through a combination of dividends from its equity holdings and income from its options strategy. However, as with any investment, there are risks and variables that can affect the level of dividend income, and these should be carefully considered in the context of an individual’s investment strategy and tax situation.

Does JEPI Pay Monthly Dividends?

Yes, JEPI stands out in the financial products landscape with its monthly dividend payment schedule, which is relatively uncommon among ETFs that typically distribute dividends quarterly. This monthly distribution is a key feature that caters to investors who prioritize regular income streams, as it can provide a more predictable flow of funds that can be particularly advantageous for budgeting or reinvestment strategies.

The dividends are sourced from the income generated through the fund’s options strategy, combined with the dividends accrued from its equity holdings. JEPI’s consistent monthly payouts are a result of this dual-income strategy, which is designed to capture income opportunities from the options market while also reaping the benefits of dividends from stable, high-yield stocks.

This focus on regular income distribution aligns with the needs of certain investor demographics, such as retirees who may rely on their investments for a steady source of income to cover regular expenses. Additionally, the monthly dividends can be reinvested back into the fund, allowing for compounding returns for those investors who do not require immediate income.

It’s crucial for investors to note that dividend payments are not guaranteed and can vary based on the actual income the fund generates from its underlying investments and options strategy. Economic downturns, changes in market volatility, and performance of the equity holdings can all influence the amount of income JEPI generates, and consequently, the dividends it pays out. Therefore, while the fund aims to maintain its monthly distribution, the actual dividend amounts may fluctuate.

Investors considering JEPI should also take into account the fund’s past performance in terms of dividend payments, which can provide an indication of the fund’s ability to generate and distribute income over time. However, past performance is not a reliable indicator of future results, and investors should remain mindful of market conditions and economic factors that could impact future dividend distributions.

When Are JEPI’s Key Dividend Dates?

JEPI’s dividend schedule is a crucial aspect for investors, particularly those who prioritize regular income or are planning their investments around dividend distributions. JEPI follows a monthly dividend distribution schedule, which sets it apart from many funds that opt for quarterly or semi-annual dividends. Understanding JEPI’s dividend schedule, including the ex-date, record date, and pay date, is essential for investors.

The ex-date is the first date when buying a stock does not entitle the new buyer to the declared dividend; the record date is when the company looks at its records to determine who the shareholders are; and the pay date is when the dividend is actually paid out.

Looking at JEPI’s recent dividend history:

- The dividend declared on December 28, 2023, with an ex-date of December 28, 2023, and a pay date of January 3, 2024, was $0.42781 per share.

- Prior to that, on December 1, 2023, JEPI paid $0.39025 per share, with the ex-date being December 1, 2023, and the pay date December 6, 2023.

- Going further back, for November 1, 2023, the dividend was $0.35892 per share, with an ex-date of November 1 and a pay date of November 6, 2023.

This pattern of consistent monthly dividends is evident throughout the year, with each month seeing a dividend payment, although the exact amount of the dividend varies. For example, in July 2023, the dividend was $0.3593 per share, and in May 2023, it was $0.42458 per share.

The fluctuating amounts of the dividend payments reflect the dynamic nature of JEPI’s income generation, influenced by the performance of its stock holdings and the income from its options strategy. These variations highlight the importance for investors of monitoring the fund’s performance and market conditions, as these factors can directly impact the dividend amounts.

For investors who rely on these dividends for income, or who are using a dividend reinvestment strategy, understanding these key dates and the variability in dividend amounts is essential for planning and managing their investments effectively. The regular monthly schedule provides frequent opportunities for income or reinvestment, but the varying dividend amounts underscore the need for investors to stay informed about the fund’s performance and market trends.

Why Does JEPI Pay Monthly Dividends?

JEPI’s monthly dividend payment structure is designed to provide investors with a regular and frequent income stream. This approach stands out in the investment world, where quarterly dividend payments are more common. The monthly distribution of dividends by JEPI is a strategic choice, aligning with its objective to offer current income alongside the potential for capital appreciation.

The fund achieves this regular income distribution primarily through its dual strategy of investing in large-cap U.S. stocks and engaging in an options selling strategy. The dividends from these large-cap stocks, combined with the income generated from selling options, create a pool of earnings that can be distributed to investors on a monthly basis. This strategy is particularly appealing to those investors who rely on their investment portfolios for regular income, such as retirees or individuals seeking a steady cash flow.

Moreover, the monthly dividend payments can also benefit investors looking to reinvest their dividends, as it provides more frequent opportunities to compound their investment. The reinvestment of dividends can potentially lead to higher long-term returns due to the compounding effect, which is more pronounced with more frequent reinvestment intervals.

It’s important for investors to understand that while JEPI aims to provide monthly dividends, the amount of these dividends can vary. Dividend payments depend on the actual income generated by the fund’s investments and the success of its options strategy, both of which can be influenced by market conditions and the performance of the underlying assets.

What is JEPI’s Risk Profile?

Understanding the risk profile of an investment like JEPI is crucial for investors to align their portfolio with their individual risk tolerance and investment goals. JEPI, like any investment product, carries inherent risks, despite its strategy to provide income and potential for capital appreciation with reduced volatility compared to the broader market.

The primary risk associated with JEPI arises from its investment in large-cap U.S. stocks. While large-cap stocks are generally considered less volatile than their smaller-cap counterparts, they are still subject to market risks, including economic downturns, changes in market sentiment, and sector-specific disruptions. These factors can affect the stock prices of the companies JEPI invests in, potentially impacting the fund’s overall value.

Another significant aspect of JEPI’s risk profile is its options selling strategy. Options, by nature, are complex financial instruments that can carry high levels of risk. The income generated from selling options can fluctuate based on market volatility and other factors. In periods of high market volatility, the options strategy could result in lower income generation, or in a worst-case scenario, significant losses.

Furthermore, the fund’s dividend strategy, while aiming to provide a regular income stream, is not immune to risk. The dividends are dependent on the performance of the underlying stocks and the success of the options strategy. Should the companies in JEPI’s portfolio reduce or eliminate their dividends, or should the options strategy underperform, the fund’s dividend payments could decrease or become inconsistent.

It’s also important to consider the impact of interest rate changes on JEPI. As with many income-focused investments, shifts in interest rates can influence the fund’s performance. Rising interest rates, for example, can make the fixed income from dividends less attractive compared to other investments, potentially affecting the fund’s price.

Why Does JEPI’s Dividend Fluctuate?

The dividends paid out by JEPI are subject to fluctuations due to several factors inherent in its investment strategy and the nature of the markets it operates in. Understanding these factors is crucial for investors in setting realistic expectations about the income stream from JEPI.

A primary factor influencing JEPI’s dividend amounts is the performance of its equity holdings. Since a portion of the dividends comes from the stocks in its portfolio, any changes in the dividend policies of these companies, or their profitability, can directly affect JEPI’s dividend payouts. If these companies face economic challenges or decide to reduce or eliminate their dividends, JEPI’s dividend distribution can decrease accordingly.

Another significant element in JEPI’s dividend variability is its options selling strategy. The income from this strategy depends on the premiums received from selling options, which can vary based on market volatility and the price movements of the underlying stocks. During times of high market volatility, option premiums tend to increase, potentially leading to higher income for JEPI. Conversely, in periods of low volatility, the income from option premiums may decrease.

Additionally, the overall market conditions play a role in JEPI’s dividend payments. Economic downturns, changes in interest rates, and shifts in market sentiment can all impact the performance of JEPI’s investments and its ability to generate income. For instance, in a bear market, the reduced value of the fund’s equity holdings and possibly lower option premiums can result in decreased dividend amounts.

It’s also worth noting that the fund’s operational expenses, which are deducted from its income, can impact the dividend amounts. While these expenses are a normal part of fund operations, any changes or increases in them can reduce the net income available for distribution as dividends.

How Are JEPI’s Dividends Taxed?

The taxation of dividends from an ETF like JEPI is an important consideration for investors, as it can impact the overall return on investment. Dividends from JEPI, as with most ETFs, can be subject to different tax treatments depending on their classification as qualified or non-qualified dividends.

Qualified dividends are taxed at a lower capital gains rate, which is generally more favorable for the investor. For dividends to be classified as qualified, they must meet certain criteria set by the IRS, including being paid by a U.S. corporation or a qualified foreign corporation, and the investor must have held the ETF shares for a minimum period.

However, not all dividends distributed by JEPI may be qualified. A portion of JEPI’s income is generated from its options selling strategy, which is typically classified as ordinary income rather than qualified dividends. This means that this portion of the dividends could be taxed at the investor’s regular income tax rate, which may be higher than the capital gains tax rate.

The distinction between qualified and non-qualified dividends is crucial in understanding the tax liability associated with investing in JEPI. The tax treatment of these dividends can affect the net income received by the investor and should be considered when calculating the overall return on the investment.

Investors in JEPI should review their dividend statements to understand the classification of their dividends and consult with a tax professional to fully understand the tax implications. Tax laws can be complex and may change, so staying informed about current regulations and how they apply to investment income is essential for effective tax planning and management.

Is JEPI a Good ETF?

Evaluating whether JEPI is a “good” ETF depends on various factors including its investment strategy, performance, risk profile, and how it aligns with an investor’s specific goals and risk tolerance.

JEPI employs a unique strategy combining option selling with investments in U.S. large-cap stocks. This approach is designed to provide regular income through dividends and option premiums, alongside the potential for capital appreciation. For investors seeking a combination of income and growth potential, and who are comfortable with the complexities and risks of an options-based strategy, JEPI could be an attractive option.

In terms of performance, JEPI’s history shows it has been capable of delivering competitive returns compared to its benchmarks and peers. For example, its growth since inception and its resilience in different market conditions are points often considered by investors. However, it’s important to note that past performance is not indicative of future results, and the ETF’s performance should be continuously monitored.

The risk profile of JEPI is also a critical consideration. While it aims to provide income with less volatility compared to the broader market, it is still subject to market risks, including the inherent risks in its equity holdings and the additional complexities of its options strategy. Investors need to assess whether these risks align with their individual risk tolerance and investment objectives.

Furthermore, the ETF’s expense ratio, dividend yield, and the tax treatment of its distributions are important factors. JEPI’s expense ratio is competitive within its category, and its yield has been attractive, though investors should be aware of the tax implications of the dividends received.

Investors also need to consider how JEPI fits into their overall investment portfolio in terms of diversification and correlation with other assets they hold. JEPI’s focus on large-cap U.S. stocks and its options strategy might offer diversification benefits, depending on an investor’s existing portfolio composition.

Is JEPI a Safe Investment?

Determining whether investing in JEPI is a wise decision requires an individual assessment of various factors, including investment objectives, risk tolerance, market knowledge, and the overall composition of the investor’s portfolio.

JEPI’s investment strategy, focusing on generating income through a mix of dividend-paying large-cap stocks and an options selling strategy, is designed to appeal to investors seeking regular income and potential capital appreciation. This approach can be particularly attractive in a low-interest-rate environment or for those who require consistent cash flow, such as retirees.

However, the fund’s use of an options strategy adds a layer of complexity and risk. While this approach has the potential for higher income generation, it also carries the risks associated with options trading, including the possibility of underperformance in certain market conditions. Investors need to be comfortable with these risks and understand how options strategies work.

The performance history of JEPI, showing its ability to deliver returns and manage volatility, is another critical factor. While past performance is not indicative of future results, it can provide insights into how the fund has navigated different market conditions.

Additionally, the tax implications of JEPI’s dividends, particularly the distinction between qualified and non-qualified dividends, can affect the overall after-tax return on the investment. Investors should consider how these tax aspects align with their overall tax planning strategies.

JEPI’s fit within an investor’s existing portfolio is also essential. The fund’s focus on U.S. large-cap stocks may offer diversification benefits, depending on the current portfolio composition. However, investors should be wary of over-concentration in any single asset class or strategy.

Is JEPI a Buy?

The decision to buy shares of JEPI, like any investment decision, should be based on a comprehensive evaluation of various factors including individual financial goals, risk tolerance, investment horizon, and the specific attributes of JEPI itself.

JEPI’s investment strategy, which involves a combination of selling options and investing in U.S. large-cap stocks to generate income, is distinctive. This strategy aims to provide regular income through monthly dividends, which can be attractive for investors seeking steady cash flow. However, the success of this strategy is tied to market conditions and the performance of its underlying assets, which introduces a level of risk and potential variability in income.

Additionally, the fund’s performance history gives an indication of its ability to deliver returns and manage risk. For instance, JEPI has shown resilience in different market conditions, but like all investments, past performance is not indicative of future results. The fund’s performance should be evaluated in the context of the broader market and against comparable investment products.

Another consideration is the fund’s expense ratio, which affects the net return on investment. JEPI’s expense ratio, as of the latest data, stands competitively, which is an important factor for cost-conscious investors.

Investors should also consider how JEPI fits within their overall investment portfolio. Diversification is a key principle in investing, and it’s important to assess how an investment in JEPI aligns with other assets in terms of risk, return, and correlation.

Tax implications are another critical aspect. Understanding how dividends from JEPI are taxed, and whether they are classified as qualified or non-qualified, can impact the after-tax return, which is an important consideration for investors.

The answer to “Should I buy JEPI?” depends on individual financial circumstances and investment goals. It is advisable for potential investors to consult with financial advisors to ensure that an investment in JEPI aligns with their overall investment strategy and objectives.

How is JEPI Taxed?

JEPI dividends can be taxed in different ways depending on the nature of the income and your individual tax circumstances. Here’s a breakdown:

Types of JEPI Income

Equity Dividends: These are traditional dividends paid by the underlying companies held in JEPI’s portfolio. They are generally taxed as qualified dividends if you meet the holding period requirements (typically owning the shares for at least 60 days during the 121-day period before the ex-dividend date). This means they are taxed at a lower rate compared to ordinary income, potentially 0% depending on your tax bracket.

Options Premium: This income is generated from the written call options in the Equity-Linked Notes (ELNs) held by JEPI. The Internal Revenue Service (IRS) currently views this income as ordinary income, meaning it’s taxed at your regular income tax rate.

Return of Capital: In some cases, a portion of JEPI’s distributions might be classified as a return of capital. This means it doesn’t represent taxable income but reduces the cost basis of your shares. However, when you eventually sell your shares, you’ll owe capital gains taxes on any increase in the value above your adjusted cost basis.

Factors Affecting Tax Treatment

Account Type: If you hold JEPI in a tax-advantaged account like an IRA or 401(k), you may defer or avoid taxes on the dividends altogether, depending on the account type and its rules.

Tax Bracket: The specific tax rate you’ll pay on JEPI dividends depends on your overall income and tax bracket.

Recommendations:

Consult a Tax Advisor: Due to the complexities of classifying and taxing JEPI’s income streams, it’s highly recommended to consult a qualified tax advisor for personalized advice on how your specific holdings and circumstances might affect your tax situation.

Review JEPI Tax Documents: JEPI provides tax-related information in its annual reports and other documents. While not a substitute for professional advice, these resources can offer additional insights into the potential tax implications of JEPI dividends.

Frequently Asked Questions About JEPI

1. What’s JEPI?

JEPI, or JPMorgan Equity Premium Income ETF, is an exchange-traded fund that seeks to generate income through a combination of selling options and investing in U.S. large-cap stocks. It aims to provide monthly income streams from option premiums and stock dividends while also offering potential for capital appreciation.

2. How does JEPI generate income?

JEPI generates income through two primary methods: dividends from its holdings in U.S. large-cap stocks and income from a covered call options strategy. This dual approach aims to provide consistent monthly income to investors.

3. What are the risks associated with investing in JEPI?

Risks include market volatility affecting the value of its large-cap stock holdings, potential fluctuations in dividend payouts, and the complexities and inherent risks of the options strategy. Additionally, the fund’s performance is subject to economic and market conditions.

4. Is JEPI suitable for long-term investment?

JEPI can be suitable for long-term investment depending on an investor’s goals, risk tolerance, and need for regular income. However, investors should consider the fund’s strategy, performance history, and how it fits within their overall portfolio.

5. How often does JEPI pay dividends?

JEPI pays dividends on a monthly basis. The amount of these dividends can vary based on the income generated from its investments and options strategy.

6. Are JEPI’s dividends qualified?

The qualification of JEPI’s dividends for tax purposes depends on IRS rules. While a portion of the dividends (from stock holdings) may be qualified, the income from the options strategy is typically taxed as ordinary income.

7. How has JEPI performed historically?

JEPI’s historical performance has shown a capacity for providing competitive returns and managing volatility. See the section above about JEPI vs. SPY for more details. However, past performance is not indicative of future results, and investors should consider current market conditions and future prospects.

8. What is the expense ratio for JEPI?

As of the latest data, JEPI’s expense ratio stands at 0.35%, which includes costs associated with managing and operating the fund.

9. Can JEPI dividends fluctuate?

Yes, the dividends from JEPI can fluctuate. They depend on the performance of its stock holdings and the success of its options strategy, both of which can be influenced by market conditions.

10. How does JEPI fit into an overall investment strategy?

JEPI can complement an investment portfolio by offering potential income and growth with a strategy that includes a mix of equity and options trading. It’s essential for investors to consider how JEPI aligns with their investment objectives, risk tolerance, and portfolio diversification needs.

11. What factors influence the amount of dividends JEPI pays?

The dividend amount JEPI pays is influenced by the performance of its equity holdings, the success of its options strategy, and overall market conditions. Fluctuations in dividend payments can also result from changes in the dividend policies of the companies within JEPI’s portfolio.

12. How does JEPI’s options strategy work?

JEPI employs a covered call options strategy, where it sells call options on stocks it holds or on indices. This strategy generates income from the premiums received for selling these options, supplementing the dividends from its stock holdings.

13. Can JEPI’s dividend payments be reinvested?

Yes, investors in JEPI have the option to reinvest their dividends back into the fund, allowing for compound growth over time.

14. What role do JEPI’s fund managers play in its performance?

JEPI’s fund managers are responsible for stock selection, managing the options strategy, and overall portfolio management. Their decisions significantly impact the fund’s performance and ability to generate income.

15. How does market volatility affect JEPI?

Market volatility can impact JEPI’s performance, particularly its options strategy. Higher volatility leads to higher option premiums, potentially increasing income generation, while lower volatility can have the opposite effect.

16. Is JEPI a suitable investment for retirement portfolios?

JEPI can be a suitable addition to retirement portfolios, especially for investors seeking regular income streams. However, the suitability depends on individual retirement goals, risk tolerance, and other portfolio holdings.

17. What is the official website for JEPI?

JEPI website: https://am.jpmorgan.com/us/en/asset-management/adv/products/jpmorgan-equity-premium-income-etf-46641q332

JEPI prospectus: https://am.jpmorgan.com/us/en/asset-management/adv/products/jpmorgan-equity-premium-income-etf-etf-shares-46641q332

Alternatives to the JPMorgan Equity Premium Income ETF (JEPI)

These ETFs share characteristics with JEPI, such as a focus on income generation, equity exposure, and a strategy that might involve options trading for extra yield. Let’s dive into some ETFs that echo JEPI’s investment style.

- Global X Russell 2000 Covered Call ETF (RYLD):

- Yield: 13.27%.

- Focus: Covered call strategy on the Russell 2000 Index.

- Characteristics: Aims to provide high income through call options on small-cap stocks.

- Global X Nasdaq 100 Covered Call ETF (QYLD):

- Yield: 12.25%.

- Focus: Covered call strategy on the Nasdaq 100 Index.

- Characteristics: Offers income by selling call options on large-cap technology and non-technology stocks.

- JPMorgan Nasdaq Equity Premium Income ETF (JEPQ):

- Yield: 12.09%.

- Focus: Similar strategy to JEPI, but the Nasdaq index.

- Characteristics: Provides a combination of equity income and growth through options strategies.

- Neos S&P 500 High Income ETF (SPYI):

- Yield: 9.46%.

- Focus: Call option strategy on the S&P 500 Index.

- Characteristics: Actively manages S&P 500 stocks and call options for income generation.

- Global X S&P 500 Covered Call ETF (XYLD):

- Yield: 11.45%.

- Focus: Covered call strategy on the S&P 500 Index.

- Characteristics: Targets income generation through call options on large-cap U.S. stocks.

- iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW):

- Yield: 21.56%.

- Focus: Buy Write strategy on long-term U.S. Treasury bonds.

- Characteristics: Unique approach combining bond investment with options strategy for high income.

- WisdomTree PutWrite Strategy Fund (PUTW):

- Yield: 10.27%.

- Focus: Put writing strategy on the U.S. stock market.

- Characteristics: Employs a strategy to generate income through writing put options on the U.S. stock market.

- Horizons S&P 500 Covered Call ETF (HSPX): Employs a covered call strategy on the S&P 500 Index.

- First Trust High Income ETF (FTHI): Uses a covered call strategy on a diversified equity portfolio.

- Horizons Nasdaq 100 Covered Call ETF (QYLG): Similar to QYLD but with variations in option coverage ratios.

- iShares S&P 500 Covered Call ETF (FOVL): Applies a covered call strategy to S&P 500 stocks.

- ProShares S&P 500 Dividend Aristocrats Covered Call ETF (REGL): Combines covered calls with a focus on Dividend Aristocrats.

- Global X Dow 30 Covered Call ETF (DJIA): Targets the Dow Jones Industrial Average with a covered call strategy.

- Global X Russell 2000 Covered Call & Growth ETF (RYLG): Applies a covered call approach to the small-cap Russell 2000 Index.

- Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF (KNG): Focuses on Dividend Aristocrats with a targeted income approach.

- Cboe Vest S&P 500 Enhanced Growth Strategy ETF (ENG): Employs a unique covered call approach on the S&P 500.

- Eaton Vance Risk-Managed Diversified Equity Income Fund (ETJ): A closed-end fund using a covered call strategy on diversified equities.

- First Trust BuyWrite Income ETF (FTHY): Similar to FTHI, with a diversified equity portfolio and covered call strategy.

- Amplify CWP Enhanced Dividend Income ETF (DIVO): Focuses on high-dividend paying U.S. equities with a covered call strategy.

- BNY Mellon Covered Call & Dividend Equity Strategy Fund (DIZ): A closed-end fund combining dividend stocks and covered calls.

- Horizons Enhanced Income Equity ETF (HEX): A Canadian ETF applying a covered call strategy to Canadian equities.

- Nuveen S&P 500 Buy-Write Income Fund (BXMX): Replicates a buy-write strategy on the S&P 500 Index.

- Eaton Vance Tax-Managed Buy-Write Income Fund (ETB): Focuses on a tax-managed buy-write strategy in U.S. equities.

- Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV): Employs a tax-managed buy-write strategy.

- Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (ETW): Applies a global buy-write strategy.

- Horizons Enhanced Income International Equity ETF (HEJ): Uses a covered call strategy on international equities.

- Harvest Tech Achievers Growth & Income ETF (HTA): A Canadian ETF focusing on technology equities with a covered call strategy.

- Global X Nasdaq 100 Covered Call & Growth ETF (QYLG): Offers a covered call approach on the Nasdaq 100 Index.

- First Trust Morningstar Dividend Leaders Index Fund (FDL): Primarily a dividend-focused ETF with a covered call strategy.

- ALPS Sector Dividend Dogs ETF (SDOG): Targets high dividend-yielding stocks in the S&P 500 with a covered call strategy.

This extensive list of high yield ETFs provides a range of alternatives to JEPI, each with its distinct strategy, market focus, and income potential. From the S&P 500 to the Nasdaq 100, and from U.S. equities to international stocks, these ETFs offer diverse options for investors interested in income generation through covered calls and/or high dividend companies.

It’s crucial for investors to understand each ETF’s strategy, risk factors, and historical performance to make informed investment decisions. Please note that this article is for informational purposes only and shouldn’t be seen as financial, tax, or investment advice. Your individual financial needs and circumstances are unique, so it’s always wise to consult a financial professional or tax advisor to make the best choices for your situation.

Leave a Reply