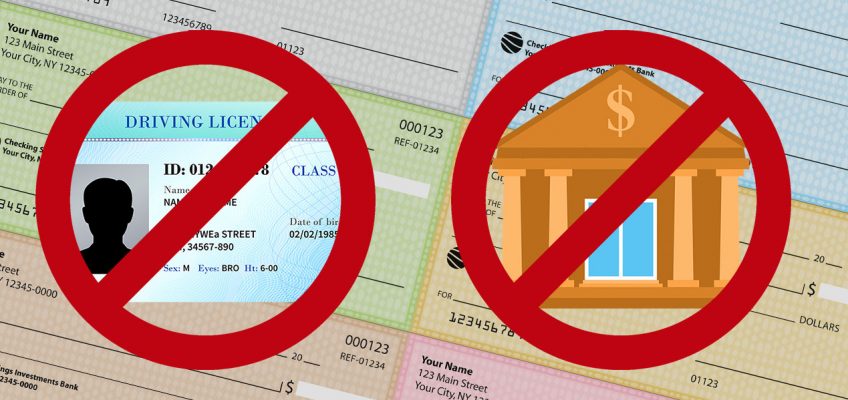

Ideally, when you receive a check, all you need to do is to visit your bank and cash it. The real problem arises when you don’t have a bank account or a valid ID.

As trivial as it may sound, more than 8.5 million households in the U.S. are unbanked and do not have a checking account according to a survey conducted by the FDIC.

Furthermore, at least 24.2 million US households qualify as underbanked, obtaining financial services outside the traditional banking system.

Cashing a check can be a major hurdle for anyone who is unbanked or underbanked.

Not having a valid form of identification such as a driver’s license or passport is also very common. A Brennan Center study found that over 21 million American adults do not have a photo ID issued by the government. Your ID may have been lost or stolen, or the name on the ID is your maiden name, or the ID has expired.

However, it is essential to know that you don’t always need a bank account or primary ID to cash a check. Continue reading to find out how you can cash a check, large or small, without having a bank account or valid identification.

Approach the Check Issuing Bank

One of the easiest and most cost-efficient options to cash a check is to visit its issuing bank. All the major banks will cash their own checks, though you may have to pay a check-processing fee as a non-customer.

Most of the banks do not charge a processing fee for small amounts, and even when a fee is applicable, it is likely to be much lower than other options. However, as a federal rule, the bank will require a valid ID to cash the check, so carry a valid id.

Visit a Retail Chain

Big retail chain supermarkets are much more than a place to shop. Most major retailers in America either cash checks themselves or partner with an in-store bank to do it for you.

Walmart, thanks to its large national footprint, is one of the most accessible retailers to cash your check. The retailer’s Walmart MoneyCenter service clears checks of up to $5,000, though it has a $200 limit for two-party personal checks. Walmart MoneyCenter processes cashier checks, printed payroll checks, insurance settlement checks, government checks, tax refund checks, and even offers a credit card.

Some alternatives to Walmart’s check cashing include money services in retailers like King Soopers, Kruger, and Kmart’s Shop Your Way membership.

Use a Mobile App

Mobile applications are by far the most accessible option in this list. Just be mindful of the fees and deposit limits.

All you need to do is install a check-cashing app, link it with a prepaid card, bank account, or PayPal, and scan the check. Depending on the app you are using, the money will be processed within a couple of hours or days, with a variable fee.

Ingo Money is the most popular check-cashing apps around. It processes checks within minutes with both premium and free cashing services. Some other alternatives include Brink’s Money Prepaid, Lodefast Check Cashing app, and ACE Mobile Loads. You can find these apps by searching for them on the Google Play Store and the Apply App Store.

Use a Prepaid Card

A prepaid debit card is one of the easiest methods to cash a check without a bank account.

You can load your prepaid card with the check, either through a partner location or online check-cashing apps. Companies that provide this service include Ingo Money, Green Dot, and NetSpend.

Make sure to compare the fees associated with prepaid cards, ranging between $5 and $10 per month. Similar to the mobile apps, there will a limit on the value of the checks you can cash.

Endorse the Check to a Family Member

If you intend to avoid the processing fee associated with check-cashing services, have a family member or a trusted friend cash your check for you. This may be the only option for depositing large checks of over $5,000 without an ID or bank account.

You’ll need to endorse the check to them by writing “Pay to the order of” followed by the new payee’s name on the back of the check.

However, there’s no absolute guarantee that he or she will pay you back, no matter how trustworthy you think they are. Some banks do not allow these types of deposits, so be sure to contact them first. We’d suggest to use this option occasionally and prefer any of the other methods on this list.

Bottom line

To wrap it up, cashing a check without a bank account or identification is similar to any other financial decision. You need to research all the options and choose the one that suits you the best.

Doreen

I wrote my sister a check for $200 for a store gift card. She lost it. She said no one else could cash it because only her name was on it.

I told her that was true. There are ways for dishonest people to cash checks without a bank account. Suggestions?