This November, voters in Los Angeles will decide whether or not to take money out of big banks and into a publicly owned bank.

In June, the city council voted unanimously to add the measure to the November ballot. If passed, it would amend the city charter to allow for a city-owned bank, which is currently prohibited unless it is approved by voters.

Advocates of the public bank believe this to be a historic movement of prosperity for the people that will show the way for other cities and states across the country.

“We are witnessing the emergence of a solution, from profit and greed to collective prosperity. We can empower our community from the ground up. It’s time to take our power back,” said Trinity Tran with the Public Bank LA campaign.

Public bank does not simply mean a publicly owned bank where someone will have a checking or savings account. Public bank enthusiasts want to finance local improvements in housing, infrastructure, and community development by employing the money citizens already pay to state and local governments for services. They believe this would democratize the financial system.

The city of Los Angeles currently has a nearly $10 billion portfolio, which is kept in private banks. In a public bank, this money could be used to help the public rather than used for the profit of the private bank owners. When a private bank hold $10 billion of the government’s money, it loans it out to others to make money off the interest. In a public bank, that money can be returned to the people rather than a few super rich people who own the private banks.

Not being a for-profit business, public banks can offer lower interest rates than private options. Because it would be a city-owned bank, any interest income would go back to the city and ultimately to the people. That will reduce financing costs, facilitates more lending, and boosts the local economy.

One working example is The Bank of North Dakota, created in 1919. It holds all state government deposits and some local government deposits. Instead of competing with other banks for loans, it lends alongside local banks that don’t have the cash to meet their customers’ needs. This has allowed North Dakota to strengthen its local banks, resulting in having the highest number of banks per capita in the U.S. During the recent financial crisis, No North Dakota banks failed.

Similar public banking options are being considered in New York City, Oakland, and San Francisco. New Jersey and Michigan are also considering state-owned banks.

“We would have more autonomy and more say in how our city resources are invested. San Francisco is one of the hottest real estate markets in the world but we’ve got an affordability crisis. Why are we not investing our dollars to solve that?” San Francisco Board of Supervisors member Malia Cohen said. “What I’m also envisioning is how a municipal bank could better support small businesses, financing small businesses run by minorities, women, veterans — those who don’t have access to the same level of capital.”

L.A. Council President Herb Wesson brought up the public bank idea in July 2017. He stated it would develop affordable housing as well as help with the legal marijuana industry, which has problems with big banks due to federal laws criminalizing the plant.

In L.A., the city government has been exploring the creation of a public bank since Council President Herb Wesson spoke of the idea in a July 2017 speech detailing his priorities for his final term. Wesson said municipally owned banks can help develop affordable housing and handle the money flowing from the newly legal recreational marijuana market.

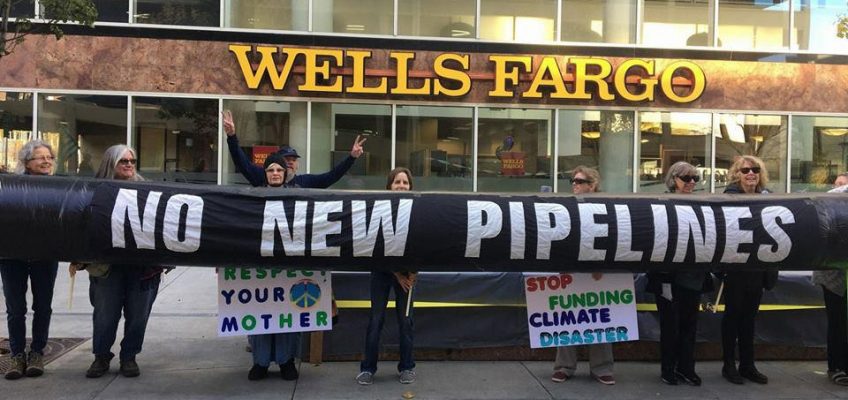

Activists were temporarily excited when they convinced the city to divest from Wells Fargo because of corruption scandals and their support for the controversial Dakota Access Pipeline. It didn’t take long before they realized the money would just go to another huge bank with basically the same issues.

“We knew divestment from one big bank to another predatory bank was unsustainable,” said Tran.

Until the November vote, Public Bank LA intends to educate voters on why they believe it is a good move for the city. They also hope to focus on, “galvanizing support from stakeholders in the community, including grassroots groups, students, community leaders, and labor,” Tran says. “We need to mobilize for a critical mass of support, to ensure a majority win in November.”