Once upon a time, buying a house was a handshake deal at the local saloon, followed by a deed transfer that might have involved trading a few horses. Okay, maybe not that informal, but it used to be significantly less bureaucratic. In the pre-digital era, the “30-day close” was often a logistical nightmare of fax machines, snail-mailed checks, and literal mountains of paper.

Today, technology has streamlined the process, digital signatures, automated underwriting, and instant transfers, yet the timeline remains stubbornly tethered to around 30 to 45 days. Why? Because despite the tech, the human elements (inspectors crawling in attics, appraisers comparing comps) and the regulatory checks (thanks, 2008 financial crisis) still take time. The modern 30-day close is a well-oiled machine, but it’s one where every gear needs to turn perfectly to hit that deadline.

The “Hurry Up and Wait” Marathon

So, the seller said “yes.” First off, pop the champagne (or sparkling cider)! That offer letter you sweated over has officially morphed into a binding contract. But before you start measuring the windows for drapes, take a deep breath. You have just entered the 30-day sprint known as “escrow” or “contract-to-close.”

It feels a bit like a rollercoaster. You start with the high-adrenaline rush of the offer acceptance, plunge into the anxiety of inspections, coast through the silence of underwriting, and finally scream your way to the closing table. The question everyone asks is: “Can we actually close in 30 days?” The answer is yes, but it requires you to be on your A-game. We’re going to walk through exactly what happens between that initial signature and the moment the heavy metal keys drop into your palm.

The Bottom Line: Speed Requires Strategy

If you are aiming for a strict 30-day close, you cannot afford to drag your feet. Based on current lending standards and 2025 market trends, the average closing actually hovers closer to 45-50 days unless the buyer is hyper-organized. To beat the average and hit the 30-day mark, you must have your financing fully pre-approved (not just pre-qualified) and respond to lender requests within hours, not days.

Your 30-Day Success Checklist:

- Day 0-3: Wire your Earnest Money Deposit (EMD) immediately.

- Day 1-7: Complete inspections and negotiate repairs aggressively.

- Day 8-15: Ensure the appraisal is ordered; lock your interest rate.

- Day 15-25: “Radio Silence” period, keep your credit frozen (no new spending!).

- Day 27: Acknowledge the Closing Disclosure (CD) immediately (the 3-day clock starts here).

For the latest rates and closing trends, sources like Bankrate and HUD.gov remain the gold standards for up-to-the-minute data.

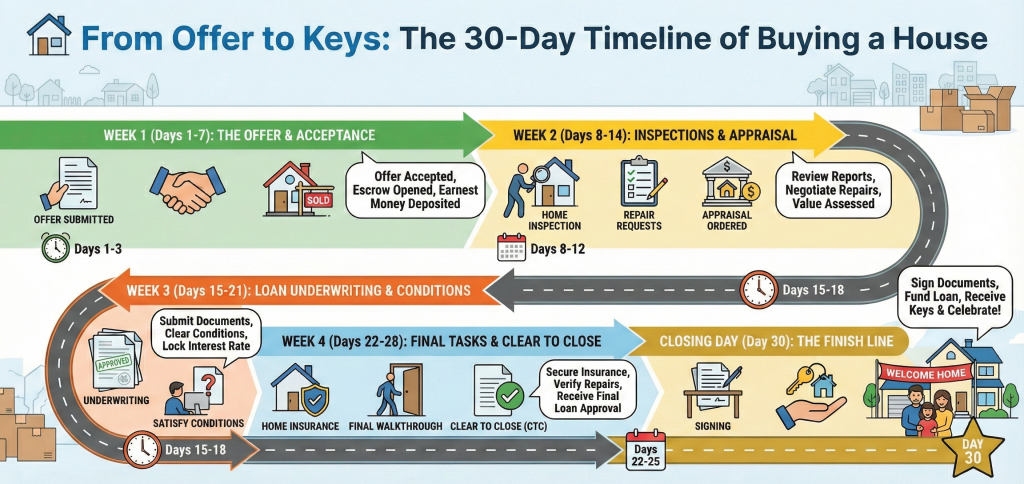

Week-by-Week Breakdown: The Anatomy of a Month

Let’s slice this 30-day timeline into digestible chunks so you don’t get overwhelmed.

Week 1: The “Kickoff” (Days 1-7)

This is the busiest week. The clock starts the moment the contract is signed. First, you’ll drop off your “Earnest Money”, basically a security deposit that says, “I promise I’m not wasting your time.” Simultaneously, you need to order the home inspection. Do not skip this. If the house has termites holding hands to keep the roof up, you want to know now. You’ll also formally apply for your mortgage. Even if you were pre-approved, you now have a specific address, which triggers the official underwriting process.

Week 2: The “Reality Check” (Days 8-14)

The inspection report comes back. Maybe the water heater is from the disco era, or the roof has “character” (read: leaks). You’ll spend this week negotiating with the seller for repairs or credits. At the same time, your lender orders the Appraisal. This is where a third party tells the bank if the house is actually worth what you offered. If the appraisal comes in low, you’re back to the negotiating table.

Week 3: The “Paperwork Purgatory” (Days 15-21)

This is the quietest but most nerve-wracking week. Your file is with the Underwriter, the financial detective whose job is to make sure you are a safe bet. They might ask for weird things, like a letter explaining why you deposited $500 cash into your account three months ago. Just give them what they want. Meanwhile, a Title Company is checking to ensure the seller actually owns the house and there aren’t any secret liens from an angry ex-spouse.

Week 4: The “Final Countdown” (Days 22-30)

You get the three most beautiful words in the English language: “Clear to Close.” You’ll receive a Closing Disclosure (CD) at least three days before signing (a federal law requirement). You do a final walkthrough of the empty house to make sure they didn’t take the chandeliers or punch holes in the walls while moving out. Finally, you sit at a table, sign your name about 50 times until your hand cramps, and wait for the funding to clear. Once it does: Keys!

Is Faster Always Better? The Pros and Cons of a 30-Day Close

Everyone wants to get into their new home yesterday, but rushing isn’t always the best play.

The Pros:

- Competitive Edge: Sellers love speed. A 30-day offer often beats a 45-day offer, even if the price is slightly lower.

- Rate Locks: Interest rate locks typically last 30 to 45 days. Closing quickly ensures your rate doesn’t expire and cost you money to extend.

- Less Rent Waste: If you’re renting, every extra week of closing is another week of paying your landlord instead of your mortgage.

The Cons:

- High Stress: If an issue pops up (like a bad inspection), you have zero buffer time to resolve it without delaying closing.

- Mistake Prone: Rushing to review 100-page loan documents can lead to missing errors in fees or terms.

- Moving Chaos: trying to pack your entire life in 4 weeks while handling mortgage paperwork is a recipe for a meltdown.

The “Don’t Buy a Boat” Rule: Financial Taboos During Escrow

This is a tangentially related but absolutely critical warning that I call the “Don’t Buy a Boat” rule. I once saw a buyer lose their dream home three days before closing because they got excited and bought a new furniture set on credit.

When you are in that 30-day window, you are under a financial microscope. The lender does a final credit check right before closing. If they see a new inquiry, a new debt, or a large mysterious cash withdrawal, they can, and will, freeze the loan.

The “Do Not Touch” List for 30 Days:

- Do not buy a car, boat, or expensive purebred poodle.

- Do not open a Home Depot credit card to buy paint (wait until you have the keys!).

- Do not quit your job to become a freelance poet.

- Do not move large sums of money between bank accounts without a paper trail.

Treat your bank account like a crime scene: nothing gets touched, moved, or altered until the tape comes down.

The Final Walkthrough (Of This Article)

Buying a home in 30 days is a whirlwind, but it’s entirely doable if you stay organized and responsive. You move from the excitement of the offer to the nitty-gritty of inspections and appraisals, survive the silence of underwriting, and emerge victorious at the closing table.

Remember: Speed comes from preparation. Get your documents ready, keep your credit score in a glass case, and communicate constantly with your loan officer. Before you know it, you’ll be eating pizza on the floor of your new living room.

Leave a Reply