If you’ve ever stared at a stack of cash-back cards wondering which one actually fits your real-life spending (you know, the combo of fast food, utilities, and random Target runs), the U.S. Bank Cash+® Visa Signature® Card is very much one of those “build-your-own-rewards” kind of deals. It doesn’t just hand you a flat rate and walk away; it lets you pick your own bonus categories like a little rewards buffet.

Historically, a lot of cash-back cards fell into one of two camps. Camp #1: simple flat-rate cards think “1.5% or 2% on everything, no thinking required.” Camp #2: rotating categories where the bank picks one or two 5% areas each quarter (like gas, grocery, or Amazon), and you just either roll with it or don’t. Those cards can be great, but you’re stuck with whatever they decide is “bonus-worthy” that quarter.

The Cash+ card came along and said, “Alright, what if you choose what earns 5%?” Instead of U.S. Bank deciding that this quarter your life revolves around, say, home improvement stores, you get to pick the categories that actually match your spending. That’s a pretty big shift: the power moves from “bank decides” to “cardholder decides.”

Over time, U.S. Bank has expanded, tweaked, and polished the list of categories. The core idea has stayed the same you get a higher rate on a limited amount of spending in certain areas but the mix now reflects modern life a lot more: streaming, cell phone providers, EV charging, and so on. It’s not stuck in a 1998 version of how people spend money.

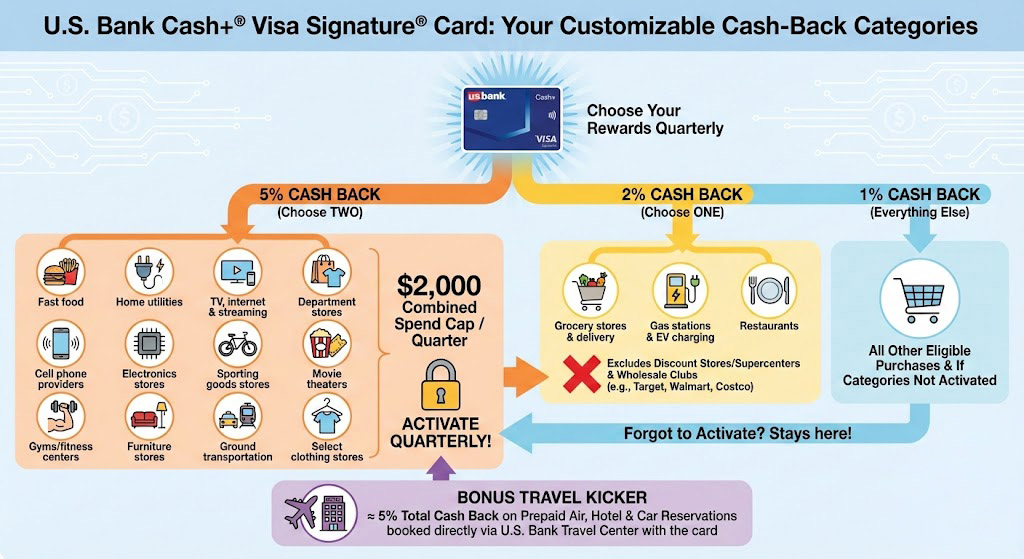

Another important piece of background: the card doesn’t just have one kind of boosted earnings. It splits things into a few layers there’s a 5% tier with more “specialized” categories (like fast food or utilities), a 2% tier with more everyday essentials (think gas, groceries, or restaurants), and then a baseline 1% on everything else. On top of that, there are some special wrinkles, like extra cash back when you book prepaid travel through U.S. Bank’s travel portal with this card.

All of that means when someone asks, “What are the Cash+ cashback categories?” they’re not just asking for a basic list. What they really need is a clear picture of how those categories work together: how many you get, how often you pick them, and what counts for what. Because if you understand that structure, the card goes from “confusing chart of categories” to “customizable rewards tool you can actually use to your advantage.”

So the context here is simple but powerful: you’re dealing with a card that lives in the middle ground between “set it and forget it” and “I need a spreadsheet to manage this.” It rewards a little bit of attention and planning. Once you know the categories and how they’re organized, you can make this card do some very respectable heavy lifting for your everyday budget.

The Short Answer: What Cash+ Actually Pays You On

Alright, let’s cut straight to it: the U.S. Bank Cash+® Visa Signature® Card is basically a “choose your own adventure” cash-back card where you pick your bonus categories every quarter, and the categories are very clearly defined.

-

- The U.S. Bank Cash+ Visa Signature Card lets you choose two 5% cash-back categories from a set list (like utilities, fast food, streaming, cell phone providers, and more), one 2% cash-back category (gas/EV charging, groceries, or restaurants), gives around 5% total back on prepaid travel booked through U.S. Bank’s Travel Center with the card, and earns 1% back on everything else.

Now let’s break that into the actual buckets and spell out the categories, because that’s what really matters when you’re deciding if this card fits your spending.

Big picture, the earning structure looks like this:

- 5% cash back – on your first $2,000 in combined eligible purchases each quarter in two categories you choose.

- 2% cash back – in one everyday category you choose.

- Around 5% total on prepaid travel – when you book prepaid air, hotel and car reservations through the U.S. Bank Travel/Rewards Center with the card (1% base + 4% extra = 5% total effective cash back on that travel spend).

- 1% cash back – on all your other eligible purchases.

You only get the 5% and 2% rates after you activate your categories each quarter; if you forget, everything just earns 1%.

All the official wording and current category list live on U.S. Bank’s site here: U.S. Bank Cash+ Visa Signature page.

The program rules (including caps and the travel kicker) are detailed here: Cash+ Program Rules.

Now, onto the exact categories.

5% cash-back categories – choose two per quarter (up to $2,000 combined spend)

Each quarter, you pick any two of these 5% categories, and you’ll earn 5% cash back on the first $2,000 in combined eligible purchases across those two categories for that quarter. After you hit that cap, those purchases drop to 1% until the quarter resets. The current standard list from U.S. Bank includes:

- Fast food

- Home utilities

- TV, internet & streaming services

- Department stores

- Cell phone providers

- Electronics stores

- Sporting goods stores

- Movie theaters

- Gyms/fitness centers

- Furniture stores

- Ground transportation (think things like buses, rail, taxis, rideshare, etc.)

- Select clothing stores

U.S. Bank keeps a category list and sample-merchants detail here if you ever want to sanity-check whether a store should code into a given category: Cash+ category & merchant detail.

2% cash-back “everyday” category – choose one per quarter

On top of the two 5% categories, you also pick one “everyday” category that earns a flat 2% cash back on all eligible purchases in that bucket. There’s no published quarterly cap on this 2% category; it just quietly does its thing. Current options:

- Grocery stores and grocery delivery (excluding discount stores/supercenters and wholesale clubs)

- Restaurants

- Gas stations & EV charging stations (again, discount stores/supercenters and wholesale clubs excluded)

If you already have another card that crushes one of these categories (for example, a separate gas card that earns 4%–5% on fuel), it often makes sense to choose a different 2% lane with Cash+ so you’re not duplicating effort.

Extra 5%-ish on prepaid travel through U.S. Bank’s Travel/Rewards Center

There’s a slightly nerdy but very nice bonus: when you use your Cash+ card to book prepaid air, hotel, and car reservations directly through U.S. Bank’s Travel / Rewards Center (online, in-app, or by phone), you earn an additional 4% cash back on top of the base 1% which is effectively 5% total cash back on that travel spend.

Important nuance: this travel bonus is separate from your quarterly 5% categories and doesn’t eat into that $2,000 quarterly cap. It’s its own thing, governed by the travel program rules, as long as you’re booking the right kind of prepaid travel through the correct U.S. Bank portal.

1% on everything else (or if you forget to activate)

Anything that doesn’t fall into your chosen 5% or 2% buckets earns a flat 1% cash back. Also, if you don’t log in and choose your categories for the quarter, you’re stuck at 1% across the board for that entire period, which is… a little tragic, honestly.

So, from a “what are the categories?” standpoint, the story is:

- A fixed, published list of 12 different 5% categories (you pick any two each quarter, up to $2,000 combined spend).

- A smaller list of three 2% “everyday” categories (gas/EV, groceries, restaurants – you pick one).

- A built-in 5% effective rate on prepaid travel booked through U.S. Bank’s Travel/Rewards Center with the card.

- 1% on everything else, or on all purchases if you don’t activate categories in time.

Quick recommendations so this isn’t just trivia

If you want to actually use these categories well instead of just admiring them from afar:

- Use 5% for your “boring but big” spending. Stuff like home utilities, cell phone providers, and TV/internet/streaming are great picks because those bills just… keep happening. If you’re paying them anyway, might as well get 5% back.

- Pair a 5% “bill” with a 5% “lifestyle” category. For example, “Home utilities” + “Fast food,” or “Cell phone providers” + “Ground transportation,” depending on your life. That way you don’t end up with a category you barely use.

- Choose your 2% lane based on the rest of your wallet. If you already have a great grocery card, maybe set Cash+ to “Restaurants” or “Gas & EV charging” instead, or vice versa.

- Don’t forget the travel portal trick. If you’re okay booking flights/hotels/cars through U.S. Bank’s portal, use Cash+ there to snag that effective 5% on travel spend.

- Set a reminder each quarter. Toss a recurring reminder in your calendar about two weeks before each new quarter so you don’t get stuck at 1% by accident.

If you line up your categories with where your money naturally goes (instead of trying to contort your life around the card), Cash+ stops being “just another 5% card” and becomes a pretty solid, very customizable rewards tool.

How the Cash+ Card’s Category System Fits Into Your Financial Life

Let’s zoom in on what we’re actually trying to figure out: when we talk about the U.S. Bank Cash+ Visa Signature Card’s “cashback categories,” we’re really talking about three things working together:

- The 5% categories you get to choose each quarter, with a spending cap.

- The 2% “everyday” category you also choose, with no stated cap on earnings.

- The 1% base rate that applies to everything that doesn’t land in those buckets (or when you mess up and forget to choose categories).

Why does this matter? Because this setup basically asks you: “Where do you naturally spend the most money?” If you’re constantly paying high utility bills, eating fast food more than you’d like to admit, or dropping cash at department stores, you can tune the card toward those habits. Instead of trying to change your life for the card, you make the card match your life.

From a personal finance perspective, this is actually kind of nice. A lot of people want to “optimize” but don’t want a wallet full of ten different cards. With the Cash+, you can often cover a couple of your bigger expense areas at a strong 5% rate, plus one more at 2%, and then just let everything else fall to 1% or another card you might already have. The customization gives you some of the benefits of a more complex multi-card strategy without going full “points hacker.”

There’s also a timing element. The categories you choose are done on a quarterly basis every three months. That means you can adjust your picks based on what’s going on in your life. Got a big move coming up? Maybe furniture stores and home utilities suddenly make sense. Planning a lot of movie nights and gym time in the winter? Those can be your 5% focus instead. You’re not locked into the same setup forever.

At the same time, the card doesn’t let you go wild with unlimited 5% across everything there’s a cap on how much spending gets that top rate each quarter. After you cross that threshold, purchases in those 5% categories drop back down to 1%. So understanding the categories isn’t just about knowing the names; it’s about knowing how far those bonus earnings stretch before you hit the ceiling.

When you ask, “What are the U.S. Bank Cash+ Visa Signature Card cashback categories?” you’re really asking two related questions:

- Exactly which spending areas qualify for 5%, 2%, and 1% cash back?

- How do those areas fit into my actual day-to-day spending so I can pick smartly each quarter?

The significance of all this is pretty big if you’re trying to squeeze real value out of your credit card instead of just blindly swiping. The categories decide whether this card is a “nice little extra” or a workhorse that covers a big chunk of your monthly expenses at 5% and 2% instead of 1%. Once we walk through the full list and rules, you’ll be able to look at your own budget and say, “Okay, here’s exactly how I’d set this up to make it pay off for me.”

Digging Into the Fine Print: How These Categories Actually Work

Now that we’ve named all the categories, let’s talk about how they actually behave in the real world because the devil with this card lives in the details: merchant coding, quarterly timing, caps, and small-but-important rules that decide whether something earns 5% or a sad little 1%.

First big piece: the quarterly structure and cap. With the Cash+ card, you:

- Pick two 5% categories every quarter.

- Pick one 2% category every quarter.

- Earn 5% only on the first $2,000 in combined spending per quarter across those two 5% categories; anything above that drops to 1% for the rest of that quarter.

So if you put $1,200 of utilities and $900 of fast food on the card in the same quarter, that’s $2,100 total in 5% categories. The first $2,000 gets 5%, the extra $100 just earns 1%. It’s a firm ceiling, not “about $2k.”

Next, the part most people sleep on: category activation is mandatory. You don’t get “auto” 5% or 2%:

- You must log in (website or app) and choose your categories in the Rewards Center every quarter.

- If you don’t pick them, every single purchase that quarter just earns 1% cash back, no matter where you spend.

So yeah, setting a recurring reminder in your calendar is not being extra; it’s basic survival if you want this card to be worth it.

Now let’s talk about the merchant coding, because this is where people either get clever or get frustrated. Your card doesn’t “see” the store the way you do; it just sees the store’s merchant category code (MCC). That’s how it decides whether that purchase counts as “fast food,” “department store,” “electronics,” and so on. U.S. Bank’s own site and sample-merchant tools basically say: we use how the merchant is classified by the payment network.

Some examples of how this plays out:

- A burger chain is usually coded as fast food, so that’s great for the 5% Fast food category.

- Your electric and gas bills? Usually perfect for Home utilities.

- Most cable and internet providers are going to sit under TV, internet & streaming services.

- A random “big box” store that sells groceries, clothes, electronics, and car oil might not count as grocery, clothing, or electronics it might just be coded as a discount/general merch store, which the card specifically excludes for 2% grocery and gas.

That last bullet is important: grocery & gas 2% categories are picky. U.S. Bank explicitly says that grocery store and gas station purchases at discount stores/supercenters (like Target or Walmart) and wholesale clubs only earn 1%, even if you’re buying food or fuel. They tightened that up further with an “important change” notice in April 2025.

Then there’s the bonus travel angle. When you book prepaid air, hotel, and car through U.S. Bank’s Travel Center using your Cash+ card, they layer on an extra 4% cash back on top of your normal 1% effectively giving you 5% total cash back on that travel. This is a separate deal from your category choices; it runs alongside them.

Put simply, the key mechanics you have to juggle are:

- A quarterly 5% cap of $2,000 combined spend in your two chosen 5% categories.

- Unlimited 2% in your chosen everyday category (subject to those exclusions).

- 5% effective on prepaid travel via the U.S. Bank Travel Center.

- Everything else and anything you forgot to activate just plods along at 1%.

Once you internalize that, the game becomes: “How do I feed the 5% and 2% buckets with spending that would happen anyway, without crossing into ‘I’m buying stuff I don’t need to chase rewards’ territory?”

In practice, most people end up with patterns like:

- 5% #1: Home utilities (electric, gas, water, trash, etc.).

- 5% #2: Cell phone providers or TV/internet/streaming.

- 2%: Gas & EV charging (if they drive a lot) or Groceries (if their grocery spend is mostly at “true” supermarkets).

That setup basically says, “I’m going to use this card to annihilate my recurring monthly bills and some everyday essentials at high cash-back rates,” which is a very sane approach.

What are the US Bank Cash+ Visa Signature Card cashback categories?

Now let’s do the thing your brain naturally wants: a clean, objective look at how good these categories actually are the perks and the annoyances.

First, here’s the full category picture in one place (current as of late 2025):

- 5% categories (choose two per quarter, $2,000 combined cap): Fast food; Home utilities; TV, internet & streaming services; Department stores; Cell phone providers; Electronics stores; Sporting goods stores; Movie theaters; Gyms/fitness centers; Furniture stores; Ground transportation; Select clothing stores.

- 2% categories (choose one per quarter, no stated cap): Grocery stores & grocery delivery (excluding discount/supercenters & wholesale clubs); Gas stations & EV charging stations (same exclusions); Restaurants.

- Travel kicker: About 5% total cash back on prepaid air, hotel, and car booked through the U.S. Bank Travel Center with your Cash+ card (1% base + 4% bonus).

- Everything else: 1% cash back.

With that on the table, let’s check the pros and cons of this setup.

Advantages of the Cash+ cashback categories

- You get to choose, not the bank. Unlike cards with rotating categories where the issuer decides what’s 5% each quarter, Cash+ lets you pick two 5% and one 2% category based on your own spending. If you’re heavy on utilities and streaming but rarely set foot in a home improvement store, you can build your bonus structure around that.

- Categories are actually relevant to modern life. The list hits real-world pain points: cell phone bills, home utilities, fast food, streaming, gyms, etc. It’s not stuck in a weird 1990s mix of “photo labs” and “video rental stores.”

- The 5% cap is relatively generous for a no-fee card. $2,000 per quarter in combined 5% spend means up to $100 in cash back per quarter from the 5% categories alone (4 × $100 = $400 per year), plus whatever you earn in 2% and travel. Many competitors cap 5% at $1,500 or have fewer categories.

- The 2% category fills a gap without needing another card. Being able to pick 2% on groceries, gas/EV, or restaurants lets this card double as your “everyday” card for at least one major expense area, especially if you don’t want a separate grocery/gas card.

- Travel multiplier is sneaky-good. That effective 5% on prepaid flights, hotels, and rental cars via the Travel Center is serious value if you’re okay booking through the bank’s portal especially for a card with no annual fee.

- It plays nicely with a simple two-card strategy. You can pair Cash+ (as your “category sniper” for bills and certain spend) with a flat 2% card for everything else, and suddenly you’re running a pretty efficient setup without needing a spreadsheet.

Disadvantages and annoyances of the cashback categories

- You have to remember to activate every quarter. If you forget to choose categories, the card turns into a basic 1% card until you fix it. There is a window where you can still pick categories late in the quarter, but it’s mental overhead you don’t have with a true “set-it-and-forget-it” card.

- The 5% cap is real if you’re a heavy spender. For a lot of people, $2,000 per quarter is perfectly fine. But if you’re stacking big utilities, heavy fast food, and an aggressively large cell phone plan, you can hit that cap faster than you expect and then drop to 1% on the rest.

- Merchant coding can trip you up. Not every store you think of as “grocery” or “clothing” will code that way. And the explicit exclusions for supercenters/wholesale clubs in the 2% grocery and gas categories mean your Walmart/Costco lifestyle won’t fully benefit from those categories.

- It’s not a great “only card.” If you just want one card and never think about categories again, Cash+ is probably not ideal. When you don’t lean into the categories, it’s mostly just 1% with occasional bonuses and there are plenty of flat 2% cards that beat that with less effort.

- Travel bonus is limited to their portal. That 5% effective on travel only applies to prepaid bookings made through U.S. Bank’s Travel Center. If you prefer booking directly with airlines or hotels for status/benefits, you’ll miss that boost.

- Category list can change over time. U.S. Bank notes that category options may change on a quarterly basis, so while the current list is strong, it’s not carved in stone. That’s normal in this space, but still something to keep an eye on.

So, are these categories actually “good”?

For a no-annual-fee, cash-back card, the answer is honestly yes if you’re willing to do a tiny bit of maintenance. The 5% categories line up really well with recurring bills and common everyday spending, the 2% lane covers at least one big budget pillar (gas, groceries, or restaurants), and the travel kicker adds a neat extra angle for trips.

If you’re the kind of person who doesn’t mind logging in once per quarter, picking categories, and maybe glancing at your statements to see what coded where, this card can sit at the center of a pretty efficient, low-drama rewards setup.

If, on the other hand, you hate all forms of “optimization homework” and just want to swipe something and be done, you’re probably better off with a flat-rate card and that’s totally fine. In that world, the Cash+ categories are technically attractive but practically wasted.

Real-Life Ways to Use Cash+ Without Needing a Spreadsheet

Let’s make this a bit more real and a bit less “credit card brochure.” You’re not sitting around all day thinking about merchant category codes and quarterly caps you’re trying to pay bills, maybe stash some savings, and not feel broke by Thursday.

So here’s how you can plug the Cash+ categories into actual day-to-day life without turning into a full-time rewards nerd.

Playbook #1: The “Bill Crusher” setup

This one is for you if your monthly fixed bills are the big stress point and you want the card to help soften that blow.

- 5% category #1: Home utilities (electric, gas, water, trash, etc.).

- 5% category #2: TV, internet & streaming services or Cell phone providers.

- 2% category: Grocery stores & grocery delivery (if most of your food shopping is at “true” grocery stores, not Walmart/Costco).

Then you just route all those bills to Cash+ and let it quietly earn. You’re not buying anything extra; you’re just making your existing fixed expenses pay you back a little more.

Why this works: Utilities and connectivity (phone, internet, streaming) are almost guaranteed repeat spending, and Cash+ literally lists those as 5% categories on the official page. U.S. Bank’s Cash+ page shows the full list: home utilities, TV/internet/streaming, cell phone providers, and more.

Playbook #2: The “Car Life” setup

Maybe your car is your second home and gas stations know you by your first name. In that case, lean into it.

- 5% category #1: Ground transportation (buses, taxis, rideshare, some parking/transport-related charges).

- 5% category #2: Fast food (because drive-thru is a lifestyle, not a phase).

- 2% category: Gas stations & EV charging stations (as long as you mostly fuel up at places coded as gas stations, not grocery/supercenter pumps).

Here, you’re using Cash+ to scoop up rewards on commuting, rideshares, and road-trip snacks. You might pair this with another card that covers groceries or online shopping so you’re not overthinking it.

Playbook #3: The “Weekend & Workout” setup

If your “fun money” tends to go into going out, staying active, and little entertainment splurges:

- 5% category #1: Gyms/fitness centers.

- 5% category #2: Movie theaters or Sporting goods stores (depending on what you actually do more).

- 2% category: Restaurants (so dining out doesn’t sting quite as much).

This is less about “optimizing every dollar” and more about offsetting the cost of keeping yourself active and entertained. If you’re paying a gym membership and hitting restaurants or movies regularly anyway, you might as well skim 5%/2% off that.

Playbook #4: The “Mini Travel Nerd” setup

Let’s say you’re not a hardcore points hacker, but you do take a couple of trips a year.

- 5% categories: You still pick whatever fits your regular life (utilities, fast food, whatever your normal quarter looks like).

- 2% category: Gas & EV charging or Restaurants (helpful for road trips or travel eating).

- Travel kicker: Use the Cash+ card to book prepaid flights, hotels, and car rentals through the U.S. Bank Travel Center to get that extra 4% on top of your 1% base so effectively 5% total back on that travel spend. The program rules confirm this extra 4% travel-center bonus. Cash+ Program Rules.

Then your mental rule is simple: “If I’m booking prepaid flights/hotels/cars and I don’t care about super niche travel tricks, I’ll check U.S. Bank’s portal first and put it on Cash+.” That’s it. No spreadsheets, no madness.

How to keep this low-effort and still smart

- Step 1: Look at the last 1–2 months of your spending (bank app, budgeting app, whatever). Circle the 2–3 big recurring categories: utilities, food, gas, streaming, etc.

- Step 2: Map those to the Cash+ category list (use U.S. Bank’s category/merchant tool here: Cash+ merchant & category list).

- Step 3: Choose your two 5% categories based on what will reliably show up every month, then pick whichever 2% category covers the remaining “big rock” in your budget.

- Step 4: Set a recurring reminder near the start of each quarter to update categories at usbank.com/cashplus or via the app.

That’s your whole “strategy.” You don’t need a points blog or a PhD in rewards optimization just a 10-minute check once every three months and a basic idea of where your money actually goes.

Quick Recap & Where to Read More

Alright, let’s tie this up so you’re not left scrolling endlessly wondering what you just read.

Here’s the core answer to your question in plain language:

- The U.S. Bank Cash+ Visa Signature Card lets you pick two 5% cash-back categories (from things like utilities, fast food, streaming, cell phone providers, fitness, etc.) on up to $2,000 in combined spending per quarter, plus one 2% category (gas/EV charging, groceries, or restaurants), gives an effective 5% back on prepaid travel booked through the U.S. Bank Travel Center, and pays 1% on everything else if it doesn’t fit or you don’t activate categories.

If you remember nothing else, remember this: the card is only “special” if you actually choose your categories each quarter and point your normal spending into them. No categories, no fun it just becomes a 1% card.

Handy official links to bookmark or peek at later:

- U.S. Bank Cash+ Visa Signature official page – shows the current 5% and 2% category list and basic card terms.

- Cash+ categories & sample merchants – see how U.S. Bank thinks about each category and which example stores fit under them.

- Cash+ rewards program rules – the fine print on caps, enrollment, travel bonuses, and all the little details.

- Cash+ activation portal / Rewards Center entry point – where you actually choose your 5% and 2% categories each quarter after signing in.

If you ever look at your monthly budget and think, “Wow, my utilities, internet, food, and gas are eating me alive,” this card’s category system is basically a way to skim a little bit back off the top of that pain. Set your categories around the stuff you’re already doing, automate the bills to the card, drop a reminder in your calendar every quarter, and you’re using Cash+ about as well as 95% of people ever will without overcomplicating your life.

Leave a Reply